Build enterprise applications without being constrained by technology. DE5260677 21100639007011 Manifest No.

Borang Kastam Hemiholohedral Ijmb Site

Form K6 JKED 4.

Kastam k1form vs k2 form. GST shall be levied and charged on the taxable supply of goods and services. Permit to transport duty paid goods within the federation. Contoh surat penawaran barang dan jasa dan tips pembuatannya.

Form K1. SEA Consignment Note 1 2 3. Zon Bebas adalah mana-mana bahagian Malaysia yang diisytiharkan di bawah peruntukan Seksyen 3 1Akta.

Vitamin K2 may be absorbed better by the body and some forms may stay in the blood longer than vitamin K1. These two things may. 3 form is required for the following circumstances aTransportation of goods between territories bTransportation of goods within the same territory.

Vitamin K is necessary for coagulation. K2 - Export for dutiable and non-dutiable goods. K2 Use for export of goods from the country K3 Transportation of Goods Between Peninsular Malaysia Sabah Sarawak and transportation within the same territory Customs No.

FORM K2 SMK STA Self Declaration 26 FORM K2 SMK STA Self Declaration 27 FORM K2 EXPORT CUSTOMS OFFICIAL RECEIPT COR PAPERLESS. Application Form for Customs Ruling. I Consignor is the trader.

Peperiksaan Jabatan Tahun 2019. Form K4 JKED 4. Application permit to move transit duty unpaid goods.

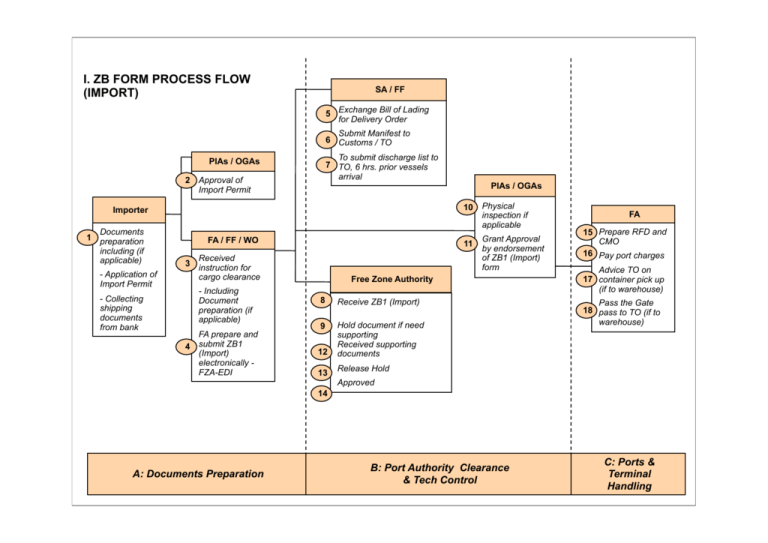

K2 Form- Customs declaration form for export K1 Form- Customs declaration form for import DNT- Dagang Net Technologies e-service provider SMK-DNT- Electronic data interchange system used by Customs for export declaration FA Forwarding Agent SA Shipping Agent. I Customs Prescribed Form No2 K2 transported to the buyer in FZ. All if any of you have experience importing goods from other country do you know how custom Malaysia calculate CIF cost insurance Freight.

Declaration of goods imported. K1 - Import for dutiable and non-dutiable goods. K2 Export Shipments K3 Export to East Malaysia K8 Impoort to Bonded Warehouse K9 Clear out a small dutiable cargo from Bonded warehouse ZB1 Import without duty in port area only ZB2 Export without duty in port area only ZB4 change Trader.

Sistem Maklumat Kastam 9 LMW - License Manufacturing warehouses. Consignee Consignor Agent. K1 CUSTOMS RELEASE DOCUMENT.

Ad Develop your enterprise applications way faster with advanced developer capabilities. MY PELABUHAN KLANG Place of Loading. Decalration of goods exported.

A supply or removal of goods from the FCZ into the Principal Customs Area PCA is treated as importation into Malaysia. CMA CGM TOSCA C1363 WBYJ Place of Import. Import licenses which may be required by a proper officer of customs.

Because this is the value that custom will charge 6 GST on me so I would love to know how this things worksRecently I purchase made a purchase from amazon USA. Integrated Import Document 8 SMK. Download form and document related to RMCD.

K3 - Import Export of dutiable and non-dutiable goods within Malaysia. 1300 888 500 Customs Call Centre 1800. The importation of goods into a FCZ directly from overseas no tax shall be chargeable on the importation excluding goods to be used in the FCZ.

Pelan Strategik Kastam 2020-2024-Web-2 APPLICATION. Research has also been done into MK molecules with even longer chains and its possible that MK-9 may have even better bioavailability than MK-7. If a partner is a financial institution referred to in section 582c2 or a depositary institution holding company as defined in section 3w1 of the Federal Deposit.

Or iii Delivery Order DO transported to LMW. Customs receives Form K2 invoice and export permit if applicable for Customs clearance. Build enterprise applications without being constrained by technology.

If the partner is not a financial institution report the gain or loss on line 5 or line 12 of Schedule D Form 1040 in accordance with the Instructions for Schedule D Form 1040 and the Instructions for Form 8949. It is for k1 form april 18 2014 at 6 31 pm post a comment. K2 - Export for dutiable and non-dutiable goods.

How to apply Exemption for all Schedules under Sales Tax Persons Exempted from Payment Of Tax 2018. Is to be paid on Customs Form No. K8 - Declaration of duty not paid goods.

K8 - Declaration of duty not paid goods. GST shall be levied and charged on the taxable supply of goods and services. Why do I care about the CIF value so much.

The declaration is to be made in ZB1 Form. K1 - Import for dutiable and non-dutiable goods. Ii Delivery Order DO transported to the buyer in LW.

At this stage however MK-7 is the most stable and bioavailable form of vitamin K on the market and it lacks the side effects associated with vitamin K1. DE HAMBURG Currency Rate. 29 BORANG K8 TEMPORARY RELEASE BY SENDING STATION RELEASE BY RECEIVING STATION PARALLEL K8 INFO.

Ad Develop your enterprise applications way faster with advanced developer capabilities. 4070136610 Vessel Name ID Voyage. 4 K1 Form - Custom declaration form for import 5 DNT -Dagang Net Technologies e-service provider 6 SMK-DNT- Electronic data Interchange system used by Customs for export declaration 7 IID.

DOWNLOAD Download form and document related to RMCD. K3 - Import Export of dutiable and non-dutiable goods within Malysia. There are no translation available.

Application Form for Renewal Of Customs Ruling. Inward manifest Form K5 JKED 4. Declaration form or related documents as follows.

Registers K2 and sends response back to forwarding agent with registration number-No cost. 4 The export declaration form or DO shall indicate the followings.

Komentar