Those who are away from Singapore for less than 48 hours will receive GST relief for goods valued up. Custom Gst Training Seminar Workshop Gst Customs Kastam Gst Tap Course Www Gst Customs Gov My Website Custom Gst Malaysia Training Gst Customs Tap Www Gst Customs Gov My.

The Ministry of Finance MoF announced that starting from 1 June 2018 the rate of the Goods and Service tax GST will be reduced to 0 from the current 6.

Kastam gst relief. Relief from charging GST under Paragraph 56 3 b of the GST Act 2014 Customs duties exempted Importation of services 15. Guide on Accounting Software. With the revocation of the GST Relief Order 2014 the supply of goods with effect from 01 June 2018 is subject to GST at the rate of 0.

B Guide on Goods and Services Tax Relief Order 2014 Item 3 First Schedule - Federal and State Government. List of Accounting Software Vendors. Tax cascading and tax compounding.

Based on the study conducted by the Ministry of Finance GST can overcome the various inherent weaknesses under SST namely. D Guide on Goods and Services Tax. GSTGST Malaysia GST Course GST Training GST Customs Malaysia GST registration GST refund GST rate GST return GST form GST relief file GST GST.

Legislation Guides Currently selected. GSTGST Malaysia GST Course GST Training GST Customs Malaysia GST registration GST refund GST rate GST return GST form GST relief file GST GST. Overview of Goods and Services Tax GST in Malaysia.

Adalah dimaklumkan bahawa Portal MyGST ini tidak lagi dikemaskini semenjak GST dimansuhkan pada 31 Ogos 2018. Payment of sales tax and service tax can be made electronically through the MySST system Financial Process Exchange FPX or manually by cheque or bank draft. No complete relief of the tax on goods exported.

List of Accounting Software Vendors. The 6 month expires at the end of Jun and the bad debt relief. Segala maklumat sedia ada adalah untuk rujukan sahaja.

REGISTER LOGIN GST shall be levied and charged on the taxable supply of. Check With Expert GST shall be levied and charged on the taxable supply of goods and services. COMPLAINT.

This GST tax amount will be calculated in proportion to the payment recovered from debtor. Troubleshooting Outstanding Invoices Not Shown As Gst Bad Debt Relief Autocount Resource Center. EVENT CALENDAR Check out whats happening.

GST Relief for International Visitors and Returning Singapore Residents Based on Value of Goods Time spent away from Singapore Value of Goods Granted GST Relief 48 hours or more S600 Less than 48 hours S150 Travellers are required to pay GST on only the value of their goods that exceeds their GST relief. Jabatan Kastam Diraja Malaysia Kompleks Kementerian Kewangan No 3 Persiaran Perdana Presint 2 62596 Putrajaya 1300 888 500 Pusat Panggilan Kastam 1800 888 855 Aduan Penyeludupan. Refer scenario B.

Kastam Gst Customs Goods And Services Tax Seminar Malaysia Videos. Invoice issued at 15th thJanuary 2016. Sesuai dipapar menggunakan Chrome versi terkini dengan paparan 1280 x 800 Hak Cipta Terpelihara 2015Jabatan Kastam Diraja MalaysiaHak terpelihara.

If they are away from Singapore for less than 48 hours they will get GST relief for goods valued up to S150. For corporate account payments B2B the amount is RM100 million. GST is to replace the current consumption tax comprising of SST.

For more information regarding the change and guide please refer to. Semakan Syarikat Berdaftar GST Berdasarkan Pendaftaran Syarikat Nama Syarikat atau Nombor GST Check For GST Registered Company. GST Calculator GST shall be levied and charged on.

GST registration GST refund GST rate GST return GST form GST relief file GST GST Act. 2 Those who spend more than 48 hours abroad will get GST relief for goods valued up to S600 double the current S300. Under the GST Act imported services means any services by a supplier who belongs in a country other than Malaysia or who carries on business outside Malaysia.

AGENCY Browse other government agencies and NGOs websites from the list. METHOD OF PAYMENT OF SALES TAX AND SERVICE TAX. You have to pay back the GST to Kastam as Ouput Tax.

Atau Puan Norzihan Binti Ikrun Pegawai Kastam Kanan Cawangan GST Muar. Issue of transfer pricing and value shifting. Guide on Accounting Software.

Travellers who spend more than 48 hours abroad will enjoy GST relief for goods valued up to S600. What is the GST treatment on the supply of goods relief under First and Second schedule of GST Relief Order 2014. 0 PAGE LIKE.

A Goods And Services Tax GST Refund Guidelines On The Acquisition Of Services By Foreign Missions And International Oeganizations Section 56 Goods and Services Tax Act 2014. A commercial development project was completed on 18 May 2018. Gst customs goods and services tax gst course gst kastam gst malaysia gst customs malaysia - gst malaysia goods and.

Malaysia GST Reduced to Zero. When a GST registered business have recovered the amount be it full or partial from their debtor they must pay back to Kastam the GST Tax amount that have claim as Bad Debt Relief earlier. For payment of taxes online the maximum payment allowable is as follows.

Sehubungan dengan itu sebarang pertanyaan dan maklumat lanjut berkaitan GST sila hubungi Pusat Panggilan Kastam 1-300-888-500 atau emailkan ke ccccustomsgovmy. Returning from overseas will enjoy more Goods and Services Tax GST relief. GST-Bad Debt Relief - Accounting Entry When you are Selling goods to customer with a Tax Invoice the double entry will be- Dr Debtor 212000 Cr Sales 200000 Cr Output Tax 12000.

Overseas exceeds their Goods and Services Tax GST relief and duty-free allowance.

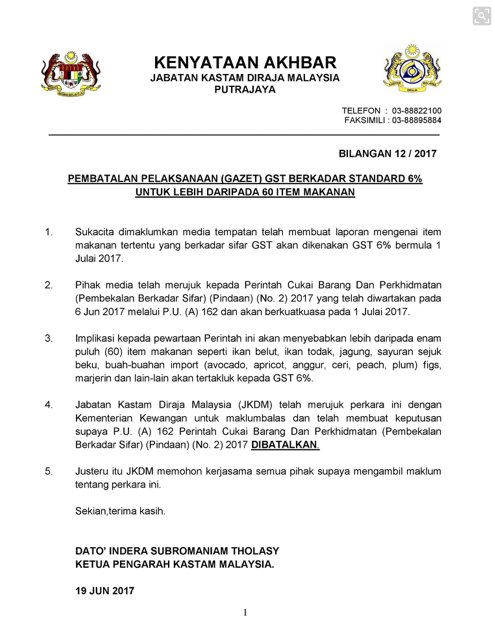

Update Malaysia Gst To Be Imposed On More Than 60 Types Of Food Items From 1st July Hype Malaysia

Komentar