The current browser does not support Web pages that contain the IFRAME element. B Control goods under Goods Control Act 1961 which are bound to price control.

Morphine heroine candu marijuana etc are strictly prohibited.

Kastam import tax list. Trying to get tariff data. Coffee not roasted 11 cents kg Coffee roasted 22 cents kg Tea. 22 Jalan SS 63 Kelana Jaya 47301 Petaling Jaya Selangor.

22 cents kg Instant coffeetea Extract essences and concentrates coffee mate. B Panduan Ejen Kastam Di Bawah Seksyen 90 Akta Kastam 1967. Prescribed drugs can only be imported into or exported from the country by virtue of.

Page 8 of 130 NAME OF GOODS HEADING CHAPTER EXEMPTED 5 10. Rules Of Origin ROO Kemudahan Partial K8. -- Choose -- PDK 2017 PDK 2017 ATIGA ACFTA AHKFTA MPCEPA MJEPA AKFTA AJCEP AANZFTA AINDFTA MNZFTA MICECA D8PTA MCFTA MAFTA MTFTA.

Calculate import duty and taxes in the web-based calculator. THE PUNISHMENT FOR DRUG TRAFFICKING IS DEATH BY HANGING. Bagi barang larangan bersyaratpermit di bawah Perintah Kastam Larangan Mengenai Import 2008 penerima perlu mendapatkan permit dari agensi berkenaan.

Electronic Pre-Alert Manifest ePAM Pre-Arrival Processing PAP INDIVIDUALS. Sekiranya barangan tertakluk kepada duti cukai pembayaran hendaklah dibuat dibuat di kaunter pembayaran PMB. 44 cents kg Carpet and other textile floor covering.

Harmonized Commodity Description Coding System commonly known as HS Codes and ASEAN Harmonized Tariff Nomenclature AHTN were created for international use by the Custom Department to classify commodities when they are being declared at the custom frontiers by exporters and importers. Contact Us Jabatan Kastam Diraja Malaysia Kompleks Kementerian Kewangan No 3 Persiaran Perdana Presint 2 62596 Putrajaya Hotline. Its fast and free to try and covers over 100 destinations worldwide.

Portal Rasmi Jabatan Kastam Diraja Malaysia Official Portal of Royal Malaysian Customs Department MySST Laman Sehenti Cukai Jualan Perkhidmatan One Stop Portal for Sales Services Tax. Borang Kastam No7 K7 Malaysian Tourism Tax System MyTTX ATA Carnet. Sehubungan dengan itu sebarang pertanyaan dan maklumat lanjut berkaitan GST sila hubungi Pusat Panggilan Kastam 1-300-888-500 atau emailkan ke ccccustomsgovmy.

D Makluman Mengenai Duti Bagi Kenderaan Import Pelajar. HS Code Item Description. A Panduan Ringkas Prosedur Import.

Borang ikrar Kastam No1 hendaklah dikemukakan bersama dengan permit. A Goods that are exempted from tax meant for export. Please refer to Sales Tax Goods Exempted From Tax Order 2018 and Sales Tax Rates of Tax Order 2018.

For GST Import cheque made will be payable to PENGARAH KASTAM NEGERI. 11 cents kg Lubricants. Pelan Antirasuah Organisasi JKDM.

Importing goods covered by a tariff-rate quota Some products are covered by a tariff-rate quota TRQ. C Due Diligence Dan Kod Etika Ejen Kastam. PROCEDURE GUIDELINES.

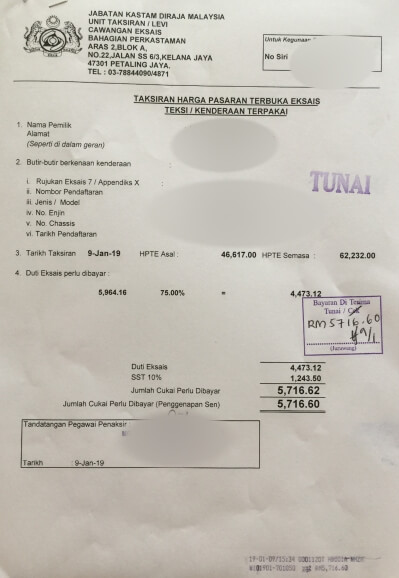

RATE OF IMPORT DUTY. Akademi Kastam Diraja Malaysia AKMAL Information Technology Division. RATE OF EXCISE DUTY.

4 The approved owner of the license must keep records and accounts related to the raw goods and components purchased or imported and the records and a sales tax officer could inspect accounts at any time. Jabatan Kastam Diraja Malaysia Kompleks Kastam WPKL No. Mat and matting Rubber Nil Wood and articles of wood.

E Garis Panduan Pelepasan Barangan Yang Dibawa Masuk Semula Dari Pelabuhan Kastam Dan Pelabuhan Zon Bebas. Cheque payable to KETUA PENGARAH KASTAM MALAYSIA GST Import should be paid according to normal importation payment procedure. Management Services and Human Resources Division.

Please make your selection. Jabatan Kastam Diraja Malaysia Kompleks Kementerian Kewangan No 3 Persiaran Perdana Presint 2 62596 Putrajaya 1300 888 500 Pusat Panggilan Kastam 1800 888 855 Aduan Penyeludupan. Import and export of illicit drugs eg.

If theres a TRQ for your product you can apply to import a limited amount at a zero or. Exemption of DutiesTaxes.

Komentar